Wise released results yesterday, and its share price fell immediately by almost 10%. I took advantage of this price movement and increased my portfolio’s position by 1%. Currently, the weight of Wise in my portfolio is over 19%.

But let’s see why Wise is such a high conviction pick for me:

Wise’s business:

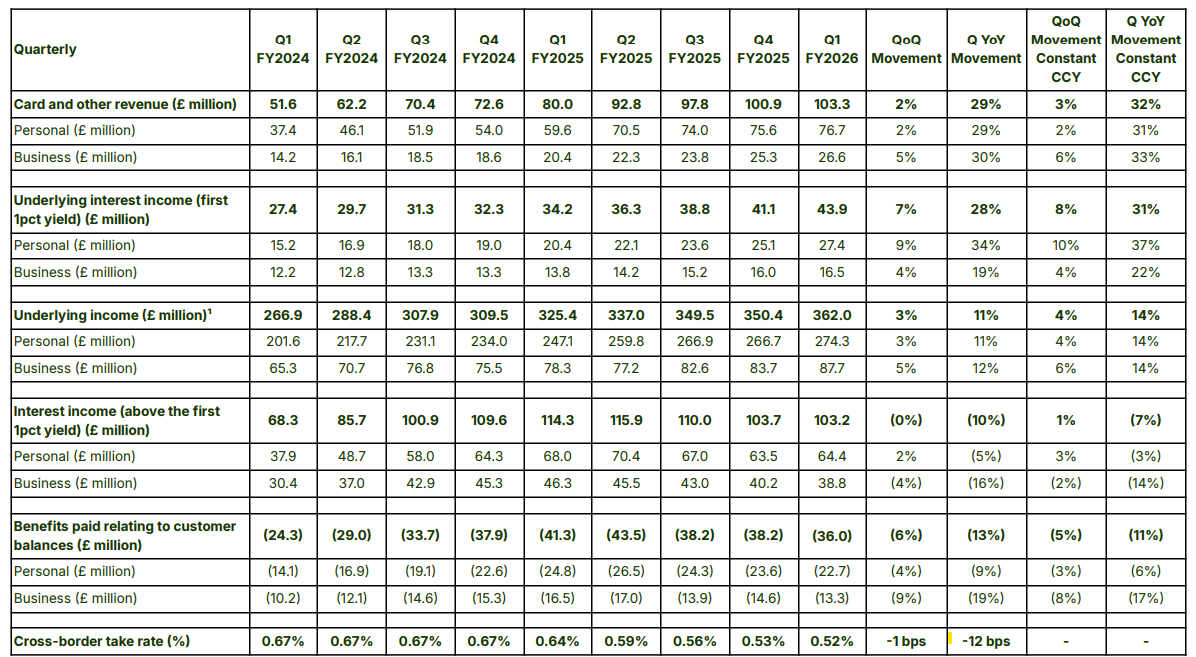

Wise’s main business is international money transfer. However, the company also generates money from cards (28% of its income in the last quarter) and from keeping money on behalf of its customers. This latest part is divided by the company in two segments: one, yield for the first 1% interest income, which accounts for 12% of the last quarter’s revenue, and income above the first 1%.

The income above the first 1% accounts for an extra income of 103.2 million pounds, in the first quarter of 2026 (total underlying income, excluding this income, is 362 million pounds).

As we see, Wise goes way beyond being a mere company of international money transfers.

The moat:

Wise is building a durable and strong moat by eliminating intermediaries in international money transfers. This allows the company to charge less to its customers while making much more money than its competitors. Also, by reducing the number of banks that the money goes through, they’ve reduced the bureaucracy that needs to be filled out, and then, most of Wise’s transfers are immediate.

As we see, the speed of transactions has been increasing consistently since 2020, reaching an impressive 65% of instant transfers in Q4 2025.

At the same time, the company has been lowering its take rates. Despite this, their net income is not shrinking, but it keeps growing, as we will see in the financials of the company.

The competitor: Remitely

According to the earnings call of Remitely, Wise’s competitor, Remitely’s take rate is 2.28%, which is “in line with their expectations”. That compares with 0.52% of Wise in their Q1 2026. What a difference!!

Remitely must be making a lot of money then, right? Well, the truth is they don’t!!! In 2024, they lost 37 million dollars with a revenue of 1,264 million dollars. WOW.

If I have to guess, when Wise can compete in the US market, Remitely will suffer a lot, both losing customers and widening their losses.

The valuation

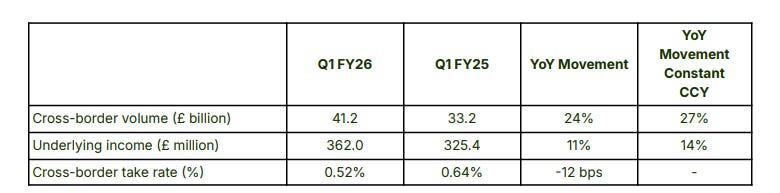

I was surprised yesterday when I saw Wise’s numbers. They were great. Cross-border volume went up 24% year over year, although underlying income “only” grew by 11% because they are lowering their take rate.

Despite that, if we consider that Wise will maintain the same level of income as in the first quarter of 2026, their total income for the year will be higher than my best-case scenario, which I’ll show you here:

According to Wise’s latest update, if they get the same revenue during the four quarters of 2026, their total revenue will be 1,623 million pounds. Also, in my forecast, I’ve applied a 16% underlying operating profit, which is probably very conservative for 2026, since their 2025 underlying operating profit was 24%. However, 16% is consistent with what the management is guiding as a long-term goal.

In my forecast, I overestimated how much they would make on interest over the first 1%. The total profit before tax would be 528 million instead of 571 million, but as I said, the underlying profit is most likely higher than 16%.

Hence, I think that maintaining my forecast as a good scenario would be wise (punch intended). With a PE multiple of 30 times earnings, I get to a valuation of 26.6 billion pounds in 2030, which is a compounded annual return of over 19% (or 143% from here to 2030).

The risk:

This valuation relies heavily on growth, from revenue growth to a generous PE multiple. Also, stablecoins may pose a risk to Wise’s business. However, the company is pushing costs lower, and the cost of settling a transaction may be even lower than the cost of settling with stablecoins. The total “take rate” for Wise is likely higher than the settling cost of stablecoins, but the private companies that back a given stablecoin must make money too, and they’ll likely be subject to financial regulations, such as Know Your Customer, anti-money laundering, and so on.

Also, lower interest rates can hurt the company, since they are having a good profit due to their customers’ balances. However, they are offsetting this lower income with a larger number of customers and a greater balance.

Conclusion:

Wise is building a great business with a wide moat. Their customers float offer a good opportunity to add profitability to the company, while they keep gaining scale to outcompete all of their competitors. With enough scale, not even stablecoins seem to be cheap enough to justify the low price the market is currently willing to pay for Wise.

If you’re interested in reading about stablecoins, you can visit this. To know more about cross-border payments, you have the information here. To know more about Wise’s business, visit this link.