MTCH

The reason behind the fall

From the end of 2021, the share price of Match Group has fallen over 70%. Once a high flier (during and after COVID), the stock has fallen in disgrace after losing users.

The main reason for the stock’s fall has been the decrease in users base. Once a COVID winner, the market seems to feel that the gains were too good to be true. However, despite users falling, revenues are still going up because of the pricing power that the company is proving.

Although losing users is worrisome, especially if the trend continues for some years, it is not especially concerning given the price increases that the company has gone through. Looking forward, we expect the effort to continue through consumables. This will push RPP higher while keeping the user base.

High market share

Match Group owns three out of the top four online dating companies.

Bumble, once considered a disruptor, has stagnated. Badoo, which used to be at the podium, has fallen considerably. Now, Match Group owns Tinder, Hinge, and Plenty of Fish (among others).

As you see in the pie above, the market share is considerable. Also, the fastest grower today is Hinge, in terms of revenue, downloads, users, and searches. Below you can see Google Trends’ searches, showing that Hinge is already placing itself in the second position among the dating apps (red is Tinder, blue is Hinge, and yellow is Bumble).

What is the market missing?

Hinge, the underdog.

The company is trading at 15 times earnings (last twelve months). This is a market-like multiple for a software company with an incumbent position in an industry with long-term tailwinds.

But more importantly, within the industry, there is a disruptor: Hinge. Its rapid growth, paired with the centralized R&D efforts that Match Group is undertaking should be a success story.

Furthermore, since Match Group is testing new initiatives in different platforms, they can roll out those that are successful among a wide portfolio of Apps, leveraging the knowledge, as well as the finances.

Conservative assumptions

Tinder maintains its position

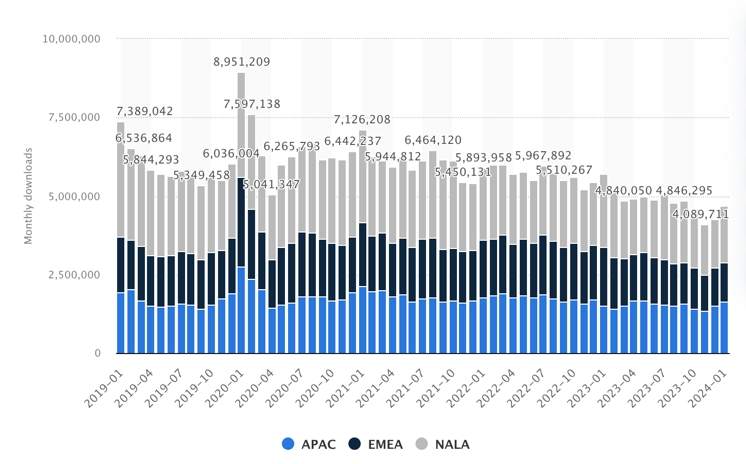

Tinder is the default go-to app for singles. It has been this way for a long time, and the trend still keeps its momentum. The number of downloads is trending downwards, but pricing efforts are maintaining the company’s revenue. It is true, however, that COVID accelerated the adoption of online dating, thus a back-to-normal trend is understandable

INTRINSIC VALUE OF MTCH

Worst case scenario, the stock won’t do much. If Hinge performs well, even with all the other apps stagnating, the stock could easily go up by over 40% in two years.

The truth is we don’t need Match Group to do much in the future for the valuation to make sense. The company is leveraged, though, but the free cash flow generation should be enough to pay down debt relatively quickly, do buybacks, or even pay a dividend. At these prices, I would love to see buybacks, which by the way, the company has pushed hard during the last year.

We will assume no growth for any app besides Hinge. Also, we will assume that the operating margins stay the same as we’ve estimated them to be in 2023 (Tinder is better than the average, evergreen and emerging average, and Match Group Asia is below the average). Hinge’s margin would improve due to its growth and operational leverage, to be eventually close to the average.

Considering this, the average margin should improve slightly from 27.72% in 2023 to 28.30%. This would be a 15% growth from today’s numbers in 2 years. If the multiple stays the same, our worst-case scenario would be a return of 15% in two years.

But this shouldn’t be the case. If the user base flattens, which should eventually do, and the market re-rates the company due to Hinge's high growth and operational leverage, returns could be great. We’re assuming a re-rating to 18 times net earnings in two years to get over a 40% return. This still leaves aside the growth that could possibly come, and that the company has actually guided, for the rest of the apps.

The estimated revenue growth estimated below is actually lower than the company’s guidance. The management expects revenue to be between $3,565 to $3,665 million. So, the 40% return could be accomplished in only one year if the management delivers what they expect.

The only red flag I see about Match Group is stock-based compensation. It has been a large part of the free cash flow, and that is why I opted to value the company with net earnings (normalizing the effective tax rate). As the free cash flow grows, it should be a smaller part of the pie, even if the aggregated amount still grows bigger.

Also, a risk to consider is disruption, as always in technology. However, I don’t think people will want to have dates with the AI, so it shouldn’t be something close to happening. But it’s something to watch.

General Publication Information

No Investment Advice

This file or any content in this webpage is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. This file is distributed for informational purposes only and should not be constructed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. It does not constitute general or personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors. The price and value of securities referred to in the file will fluctuate. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of all of the original capital invested in a security discussed in the file may occur. Certain transactions, including those involving futures, options, and other derivates, give rise to substantial risk and are not suitable for all investors.

Disclaimers

There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information set forth in this file. CCalle will not be liable to you or anyone else for any loss or injury resulting directly or indirectly from the use of the information contained in this file or webpage.

CCalle may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated on the webpage. CCalle has no holdings in this position at the time of publishing.